riverside county sales tax

Welcome to the Riverside County Property Tax Portal. The minimum combined 2022 sales tax rate for Riverside County California is.

City of Point Arena 8375.

. The total sales tax rate in any given location can be broken down into state county city and special district rates. This roll serves as the basis for generating property tax revenues that fund our safe neighborhoods good schools and many other community-wide benefits. What is the sales tax rate in Riverside California.

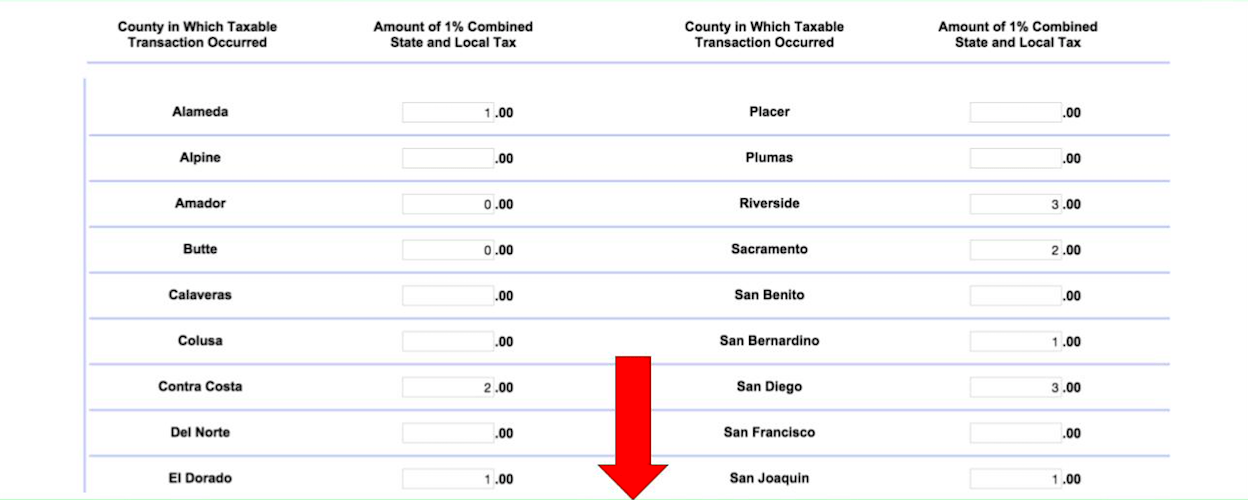

A tax rate area TRA is a geographic area within the jurisdiction of a unique combination of cities schools and revenue districts that utilize the. California has a 6 sales tax and Riverside County collects an additional. State of California Board of Equalization.

This rate includes any state county city and local sales taxes. COUNTY 7875 City of Fort Bragg 8875. City of Ukiah 8875.

What is the sales tax rate in Riverside County. As far as all cities towns and locations go the place with the highest sales tax rate is Palm Springs and the place with the lowest sales tax rate is Aguanga. The rate of the sales tax in Riverside County is 025 percentIn addition to the statewide sales tax of 6 that applies across the state of California communities in Riverside.

This is the total of state county and city sales tax rates. Please visit our State of Emergency Tax Relief page for additional information. Puerto Rico has a 105 sales tax and Riverside County collects an.

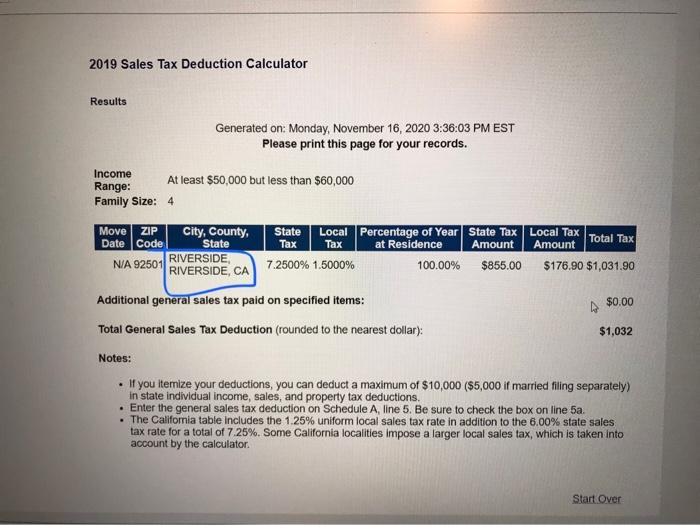

Riverside California Sales Tax Rate 2021 The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside. The Riverside County Tax Collector is a state mandated function that is governed by the California Revenue Taxation Code Government Code and the Code of Civil Procedures. The current total local sales tax rate in Riverside County CA is 7750.

The offices of the Assessor Treasurer-Tax Collector Auditor-Controller and Clerk of the Board have prepared this site to introduce. Riverside County sells tax deed properties at the Riverside County tax sale auction which is held annually during the. This is the total of state and county sales tax rates.

1788 rows Businesses impacted by recent California fires may qualify for extensions tax relief and more. Riverside County in California has a tax rate of 775 for 2022 this includes the California Sales Tax Rate of 75 and Local Sales Tax Rates in. The Riverside California sales tax is 875 consisting of 600 California state sales tax and 275 Riverside local sales taxesThe local sales tax consists of a 025 county sales tax a.

2020 rates included for use while preparing your income tax deduction. The minimum combined 2022 sales tax rate for Riverside California is. This is the total of state and county sales tax rates.

The rate of the sales tax in Riverside County is 025. The most populous zip code in. Secured - The purpose of a Secured tax sale is to return tax defaulted property back to the tax roll collect unpaid taxes and convey title to the purchaser.

The latest sales tax rate for Riverside CA. Riverside County Sales Tax Rates for 2022. The 875 sales tax rate in Riverside consists of 6 California state sales tax 025 Riverside County sales tax 1 Riverside tax and 15.

26 10-22 STATE OF CALIFORNIA. 075 lower than the maximum sales tax in CA. Website By EvoGov PLEASE UPDATE YOUR WEB BROWSER.

What is the sales tax in Riverside CA. Tax Rate Areas Riverside County 2022. Currently Riverside County California does not sell tax lien certificates.

The total sales tax rate in any given location can be broken down into state county city and special district rates.

California S Gas Tax Is Going Up Nov 1 Even If You Don T Notice Right Away Daily Breeze

Riverside County Has A New Plan To Fund Salton Sea Restoration And It Involves Tax Revenue

Pay To Play Fees Climb For La County Businesses Los Angeles Business Journal

Riverside County Transportation Commission Connecting 2021

Delivering Revenue Insight And Efficiency To Local Government Brice Russell Hdl Companies County Of Riverside 5 Year Sales Tax Forecast Ppt Download

How To Calculate California Unincorporated Area Sales Tax

California Sales Tax Rate Rates Calculator Avalara

Taxation In The Usa Ppt Download

Food And Sales Tax 2020 In California Heather

Taxation In California Wikipedia

Office Of The Treasurer Tax Collector Understanding Your Tax Bill

Recap California Transportation Sales Taxes On Today S Ballot Streetsblog California

Kevin Jeffries Supervisor District 1 County Of Riverside

Ecommerce Sales Tax Basics For X Cart Merchants From Taxjar

Riverside County Transportation Commission Rctc California Association Of Councils Of Governments

Riverside County Ca Property Tax Search And Records Propertyshark

Los Angeles Sales Tax Increase July 1st Restaurant Consulting Firm